By Mary Grlic

Protecting your IT is important for just about every industry. When dealing with finances, however, it becomes even more critical. Accounting information technology is growing in importance and requires a lot of attention to ensure total network cybersecurity. There’s a lot of crossover between the accounting field and your IT. Whether you’re an accounting firm or an accounting department, a good IT infrastructure makes it easy, efficient, and cyber-safe. IT can be used to your advantage to keep your financial data secure.

Accounting: Cybersecurity as a Top Priority

In the world of accounting, cybersecurity should be a top priority. When dealing with financial statements, a long list of clients, and highly sensitive information, protecting that data is fundamental. The risks associated with a lack of security are staggering and shouldn’t be disregarded. Without the proper cybersecurity protection and IT infrastructure, your company can be vulnerable to a great deal of risks.

Why is Cybersecurity in the Accounting Field so Important?

With the increase in hacking, malware, ransomware, and other cyberthreats, the accounting sector faces a lot of risk. Accounting involves a lot of private information that hackers can steal. This includes account numbers, transaction details, credit card/debit card numbers, usernames, passwords, social security numbers, and other highly sensitive personal information. Cyber attacks pose a risk to both employees for companies and any clients that the accounting business or department works with.

Hacking and Cyber Attacks

Most industries in the US unfortunately face the risk of cyberattacks when they’re not properly protected. In fact, the US is the highest targeted country of cybercrime. With new technologies, cyberattacks are becoming more prevalent and easier for hackers to execute. Accounting Today states that there was a 300% increase in the amount of cyber attacks in accounting professions. The increase in working from home due to Covid certainly impacted these numbers, as home networks often don’t have the proper IT infrastructure to host and protect financial information, making it easier to hack.

Human Errors and Hacking

A lot of hacking can simply be a result of human error, such as mistyping or clicking on a bad link. Phishing, for example, is a scam in which senders email fraudulent messages pretending to be a trusted source. The recipient may then open or click on a fake link/or attachment that’s actually malware or some sort of virus. Without proper cybersecurity awareness training, employees could easily fall for phishing scams, which could be harmful to the entire organization. Pharming is another risk that many businesses can face if their employees are not properly trained.

Financial Risks

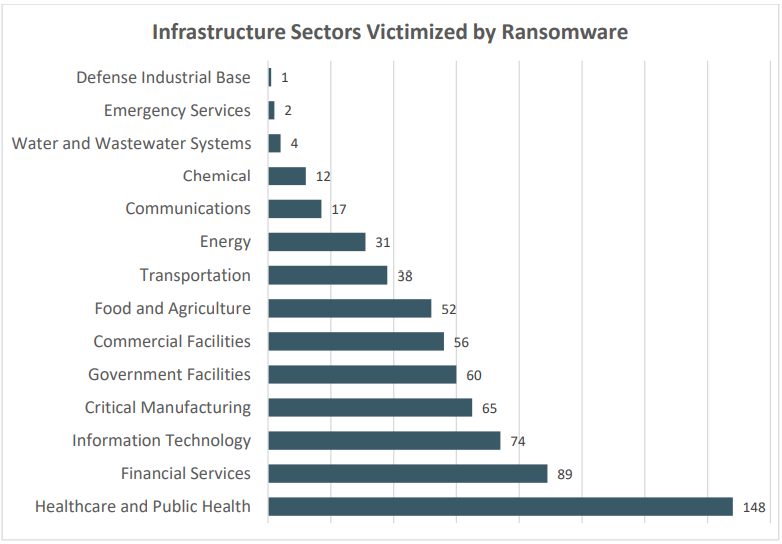

Data breaches and poor cybersecurity can pose financial risks, especially for businesses that deal with a lot of financial data like accounting firms. One wrong click can corrupt client financial information, or even put the firm at danger of other risks. Ransomware is a huge issue for a lot of organizations, especially those in accounting. Hackers can easily steal and hold data “ransom,” expecting a huge fee for businesses to pay to get that information back. That can be a huge financial burden for many companies, especially when taking into consideration that Financial Services is the 2nd largest sector victimized by Ransomware, as per page 15 of the FBI’s IC3 2021 Report.

Client Risks

Accounting firms work with a lot of personal information from clients, business partners, and more. This data is extremely confidential, and if improperly handled, may have terrible consequences. Clients can face the risk of identity theft and financial fraud, to name a few risks.

Reputation

Going back to client risks, individuals and businesses trust their financial information with accounting firms. If they hear their information (or another person’s information) is at risk, they’ll no longer trust that company. Reputation plays a huge role in this business. If a company is hacked and personal data is stolen, people will lose trust in that organization and most likely be skeptical to work with them again.

You need a Cybersecurity Plan for your Accounting Firm

Having a good cybersecurity plan and well-managed IT infrastructure is critical to keep your accounting sector safe. This will involve things like a good server for your business, well-managed email correspondence, antivirus software, and trustworthy software/applications to host any data. When building a small business network, looking at all of these aspects is critical, especially for firms or industries that handle a lot of personal financial information. Here are some parts to your cybersecurity plan that are crucial to keep your accounting business safe.

State and federal regulations

Different states and regions will have different regulations that companies must follow to keep their organization and clients safe. Knowing these compliance laws is essential to protect businesses and individuals. For example, in New York, the SHIELD Act is a set of cybersecurity compliance standards that organizations (those who meet the standard described in the act) should follow. Accounting compliance includes a few regulations that crossover with cybersecurity standards to best protect clients and their financial information.

Cybersecurity awareness training

Make sure your employees know and understand the risks their organization faces as well as ways to prevent such threats. For example, training against phishing is incredibly wise, as many employees can make accidental human errors, like clicking on a bad link, and thus, installing malware on their device. Such an incident could put your whole organization at risk. Learn more about cybersecurity awareness training and the importance of it for every company.

Use a good accounting software

Like with many online platforms, you want to make sure you’re utilizing accounting software that’s known for being safe, secure and reliable. The best accounting software on the market has financial cybersecurity programs already integrated into the software, so it’s even easier to keep your data protected. However, even with this single measure in place, it’s still critical to have a well-maintained managed IT system and infrastructure and to not solely rely on your accounting software to keep you secure. This includes things like server backup software, secure small business servers, and more.

Intuit Quickbooks

Computero trusts Intuit Quickbooks with any financial and accounting correspondence. Quickbooks has a well-protected and user-friendly platform that makes operating it very simple. Intuit cares about your cybersecurity and works to keep your data protected, backed up, and available 24/7. Quickbooks is the perfect solution for any business, especially in the accounting and finance sectors.

Antivirus

Having good antivirus is essential for all businesses. This software will protect your device from any malware. At Computero, we recommend Trend Micro XDR Vision One to safeguard any sensitive data and increase your security. XDR monitors your business with multiple layers of security, and includes key features such as more effective analysis, stopping attacks quickly, a clearer view of threats, and less time to actually detect threats. This makes Trend Micro XDR the best choice antivirus for any business, especially in the accounting industry.

Safeguard any information

The best ways to protect online data is to have good login security, use two-factor authentication (2FA), and always use trusted devices when accessing any work-related accounts or information. Choose strong usernames and passwords, and enable multi-layer authentication. This way, even if someone does acquire your login credentials, they would fail the extra layer of security needed to actually access your account. Some examples of two-factor authentication include biometric data, a security key, phone number/SMS, spare email, and more. Also, always access any accounting or financial information with a trusted device; this computer should be one with antivirus software that is managed by your organization.

Managed IT Services for Accounting

Computero works with many clients to create the best managed IT system for their business. We can help your accounting firm or industry with all the necessary parts of your IT infrastructure, including server management, antivirus, networking, wire installation, and more. Contact us today if you are interested in a better managed IT plan for your small to medium sized business needs.

0 Comments